Demonetization refers to the act of stripping a currency unit of its legal tender status. This drastic measure is usually adopted to combat corruption, counterfeit currency, and tax evasion, as well as to encourage digital transactions and promote a less cash-dependent economy. However, despite its intended benefits, demonetization often brings about several adverse consequences. This article delves into the numerous disadvantages of demonetization, emphasizing its broad and multifaceted impacts on the economy and society.

1. Economic Disruption

One of the most immediate and severe disadvantages of demonetization is the economic disruption it causes. The sudden withdrawal of high-denomination currency notes leads to a significant cash crunch. Businesses, particularly those dependent on cash transactions, face a severe liquidity crisis. This disruption hampers economic activities across various sectors, leading to a slowdown in overall economic growth.

2. Impact on Small Businesses

Small and medium-sized enterprises (SMEs) are disproportionately affected by demonetization. These businesses often operate with thin margins and rely heavily on cash transactions. The sudden unavailability of cash can result in a sharp decline in sales, creating financial instability. Many SMEs lack the infrastructure for digital payments, which further exacerbates their difficulties during demonetization.

3. Unemployment

The disadvantages of demonetization extend to the labor market. As business activities slow down, companies, particularly those in the informal sector, may reduce their workforce or lay off employees. This leads to a rise in unemployment rates, especially affecting daily wage earners and contract workers. The increase in unemployment not only impacts individuals and families but also contributes to broader economic instability.

4. Agricultural Sector Sufferings

The agricultural sector faces significant challenges during demonetization. Farmers, who often transact in cash for both buying supplies and selling produce, encounter difficulties due to the sudden cash shortage. This can delay the purchase of essential inputs like seeds and fertilizers, disrupting crop cycles and reducing yields. Furthermore, farmers might struggle to sell their produce at fair prices, leading to financial losses and increased debt burdens.

5. Social Inconvenience

The social inconvenience caused by demonetization is another major disadvantage. Long queues at banks and ATMs become a common sight as people rush to exchange old currency notes. This can be particularly taxing for the elderly, disabled, and those living in remote areas with limited banking facilities. The time spent in these queues represents lost productivity and added stress for the populace.

6. Impact on Consumption

One critical disadvantage of demonetization is its impact on consumption patterns. With a sudden decrease in available cash, consumer spending drops sharply. This reduction in consumption affects various sectors, including retail, real estate, and hospitality. The decrease in consumer spending leads to lower revenues for businesses, negatively impacting their profitability and sustainability.

7. Digital Divide

Demonetization often aims to promote digital payments as an alternative to cash. However, this shift highlights and exacerbates the existing digital divide. Many individuals and small businesses, especially in rural areas, may not have access to digital payment systems or the necessary literacy to use them effectively. This divide can result in economic exclusion for a significant portion of the population, underlining the disadvantages of demonetization.

8. Cost of Implementation

Implementing demonetization incurs significant costs. Printing new currency notes, recalibrating ATMs, and managing the logistics of distributing new notes across the country require substantial financial and administrative resources. These costs can be considerable, diverting funds from other essential developmental activities.

9. Short-term Nature of Benefits

While demonetization is often promoted for its potential to reduce black money and counterfeit currency, these benefits are generally short-lived. Individuals engaged in corrupt practices can find new ways to circumvent the system, and counterfeiters can adapt their methods to produce fake versions of new currency notes. Therefore, the long-term efficacy of demonetization in achieving these goals is questionable.

10. Psychological Impact

The psychological impact of demonetization on the public is significant. The sudden change creates uncertainty and anxiety among people. Fear of losing their savings or not being able to meet daily needs can lead to panic and stress. Such psychological impacts can affect the overall well-being of individuals and communities, contributing to social unrest.

11. Impact on Informal Economy

The informal economy, which constitutes a large part of many developing countries, is heavily reliant on cash transactions. Demonetization disrupts this sector significantly, leading to loss of income for many informal workers. Street vendors, small shop owners, and service providers find it challenging to operate without cash, highlighting the disadvantages of demonetization for this critical part of the economy.

12. Banking System Overload

Demonetization puts immense pressure on the banking system. Banks are tasked with handling the exchange of old currency notes, recalibrating ATMs, and managing increased customer footfall. This overload can strain bank resources and staff, leading to longer processing times and reduced efficiency in other banking operations.

13. Increase in Cashless Frauds

While demonetization encourages the use of digital transactions, it also opens the door to increased cashless frauds. Many people, unfamiliar with digital payment methods, can fall prey to cyber scams and frauds. The lack of digital literacy and cybersecurity measures can lead to significant financial losses for individuals and businesses, demonstrating another disadvantage of demonetization.

14. Shortage of Lower Denomination Notes

Another disadvantage of demonetization is the shortage of lower denomination notes. When high-value notes are withdrawn, there is often an insufficient supply of smaller denomination notes to meet the demand. This shortage can hinder day-to-day transactions, causing inconvenience and slowing down economic activities at the grassroots level.

15. Negative Impact on Stock Market

The stock market can react negatively to demonetization. Investor sentiment may turn bearish due to the economic uncertainty and disruption caused by the sudden change. This can lead to a decline in stock prices and overall market volatility. The negative impact on the stock market further affects investor confidence and the financial stability of companies.

16. Hurdles in Real Estate Sector

The real estate sector is another area significantly affected by demonetization. Real estate transactions often involve large sums of cash, and the sudden withdrawal of high-denomination notes can lead to a slowdown in property deals. This can result in a drop in property prices, reduced investment in the sector, and financial strain on real estate developers.

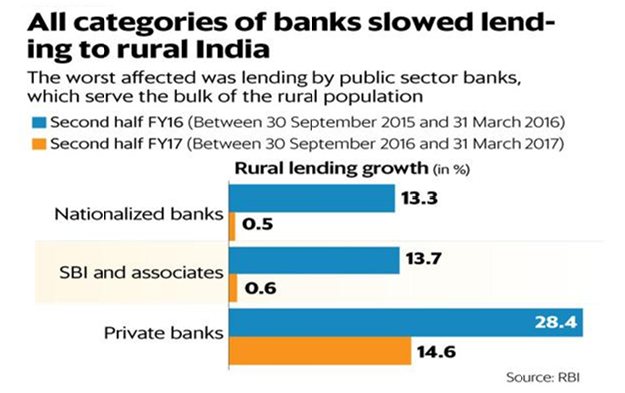

17. Challenge for Rural Economies

Rural economies face unique challenges during demonetization. Limited banking infrastructure and digital payment options make it difficult for rural residents to exchange old currency notes and adopt new payment methods. This can lead to economic stagnation in rural areas, where cash is often the primary medium of exchange, underscoring the disadvantages of demonetization for these communities.

18. Disruption in Supply Chains

Supply chains are also disrupted by demonetization. The cash crunch can hinder the flow of goods and services, as suppliers and distributors struggle to make and receive payments. This disruption can lead to shortages of essential goods, increased costs, and delays in delivery, affecting businesses and consumers alike.

19. Impact on Tax Revenue

While demonetization aims to increase tax compliance, it can also lead to a temporary decline in tax revenue. The slowdown in economic activities and the challenges faced by businesses can reduce their taxable income, leading to lower tax collections in the short term. This decline in tax revenue can impact government budgets and public spending.

20. Long-term Trust Issues

The long-term trust issues created by demonetization are perhaps one of the most significant disadvantages. The abrupt policy change can lead to a loss of trust in the financial system and government policies. People may become wary of sudden changes in monetary policy, leading to a preference for holding assets in forms other than cash, such as gold or foreign currency, which can have broader economic implications.

Conclusion

In conclusion, while demonetization is often undertaken with the intention of addressing critical economic issues, the disadvantages of demonetization are numerous and far-reaching. From economic disruption and impacts on small businesses to social inconvenience and the exacerbation of the digital divide, the drawbacks are significant. Additionally, the cost of implementation, the temporary nature of some benefits, and the psychological impact on the public further highlight the challenges associated with demonetization. Policymakers must carefully consider these disadvantages and explore alternative strategies to achieve their goals with fewer adverse effects on society and the economy.